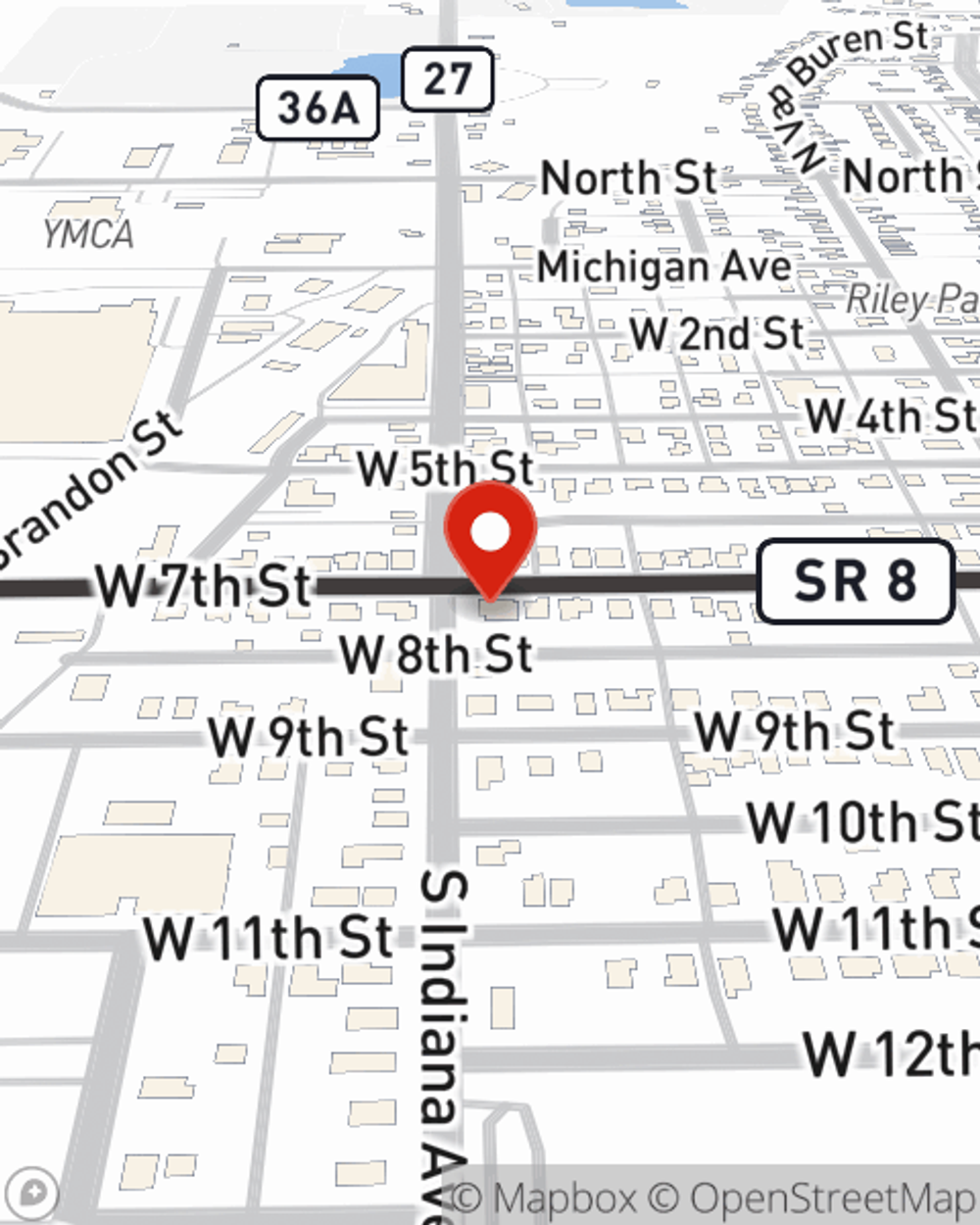

Business Insurance in and around Auburn

Calling all small business owners of Auburn!

Cover all the bases for your small business

- Auburn

- Garrett

- Butler

- Waterloo

- Leo

- Spencerville

- Saint Joe

- Laotto

- Huntertown

- Fort Wayne

- Kendallville

- Angola

- Ashley

This Coverage Is Worth It.

Running a small business comes with a unique set of wins and losses. You shouldn't have to deal with those alone. Aside from just those who care for you, let State Farm be part of your line of support through insurance options including a surety or fidelity bond, extra liability coverage and worker's compensation for your employees, among others.

Calling all small business owners of Auburn!

Cover all the bases for your small business

Get Down To Business With State Farm

At State Farm, apply for the outstanding coverage you may need for your business, whether it's a clock shop, an art school or a toy store. Agent Morgan Hefty is also a business owner and understands what you need. Not only that, but personalized insurance options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage can't be beat.

Agent Morgan Hefty is here to explore your business insurance options with you. Contact Morgan Hefty today!

Simple Insights®

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

Morgan Hefty

State Farm® Insurance AgentSimple Insights®

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.