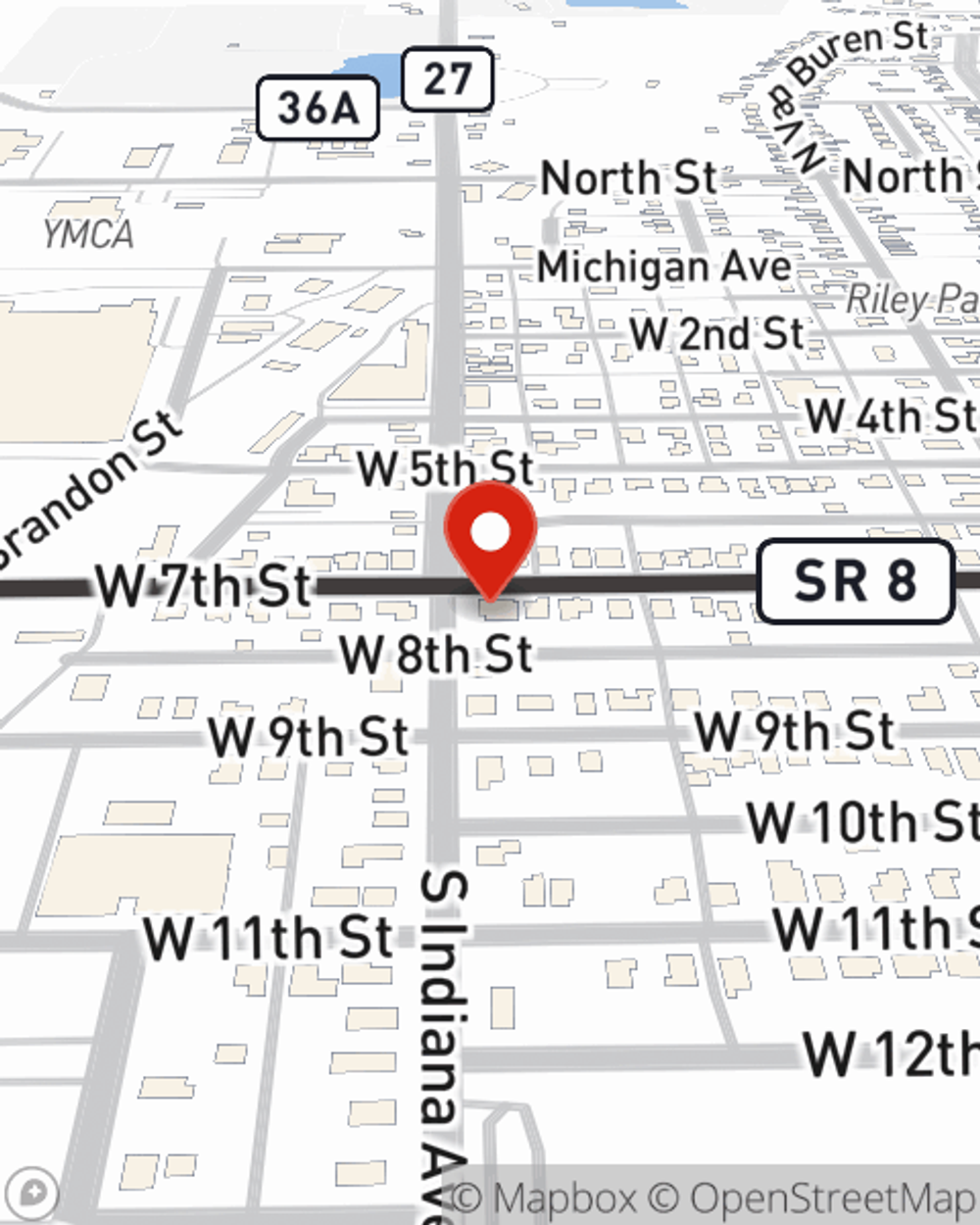

Condo Insurance in and around Auburn

Get your Auburn condo insured right here!

Condo insurance that helps you check all the boxes

- Auburn

- Garrett

- Butler

- Waterloo

- Leo

- Spencerville

- Saint Joe

- Laotto

- Huntertown

- Fort Wayne

- Kendallville

- Angola

- Ashley

Your Search For Condo Insurance Ends With State Farm

Often, your retreat is where you are most able to take it easy and enjoy the ones you love. That's one reason why your condo means so much to you.

Get your Auburn condo insured right here!

Condo insurance that helps you check all the boxes

Condo Unitowners Insurance You Can Count On

You want to protect that meaningful place, and we want to help you with State Farm Condo Unitowners Insurance. This can cover unexpected damage to your personal property from a covered peril such as hail, weight of ice or snow or fire. Agent Morgan Hefty can help you figure out how much of this wonderful coverage you need and create a policy that is right for you.

When your Auburn, IN, townhome is insured by State Farm, even if life doesn't go right, State Farm can help protect your one of your most valuable assets! Call or go online today and see how State Farm agent Morgan Hefty can help meet your condo unitowners insurance needs.

Have More Questions About Condo Unitowners Insurance?

Call Morgan at (260) 925-2924 or visit our FAQ page.

Simple Insights®

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.

Morgan Hefty

State Farm® Insurance AgentSimple Insights®

Help raise your home's worth with these simple appraisal tips

Help raise your home's worth with these simple appraisal tips

Appraisals provide an estimate of your home's value for determining its worth and are required when selling or refinancing a home or property.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.